1. Executive Summary

Accumulate uses a burn and mint equilibrium (BME) model for its native ACME token that trends deflationary with increasing network demand. A fixed percentage of ACME tokens are periodically minted from the unissued portion of its 500 million maximum supply and distributed to stakers and validators. Depending on transaction volume, a portion of the circulating supply will be burned to create Credits that users need to create Accumulate Digital Identifiers (ADIs) and write data to the blockchain. Credits are non-transferrable tokens with a fixed cost and no market value that disincentivize hacking, bypass regulatory requirements, and allow enterprises to budget effectively. Burned ACME tokens are returned to the unissued pool to be reissued in future blocks. Network use incentivizes staking and takes ACME out of circulation while increasing use of the network over time will decrease block rewards and put upwards pressure on the price of ACME. Thus, protocol use rather than speculation will drive the value of the token. The goal of increasing the value of ACME is to incentivize users to secure the network in the absence of a traditional fee model. In this report, we will examine the dual token model of the Accumulate protocol and compare its tokenomics and value proposition to that of other blockchains.

2. Introduction to Deflationary Tokenomics Models

The incentive to hold a token creates demand, while the demand of a token relative to its supply will influence its market price. A variety of strategies to incentivize holding and stimulate demand have been developed by blockchain protocols, the majority of which rely upon some variation of a deflationary tokenomics model. These models are briefly summarized below.

- Basic deflationary model: A fixed number of tokens are created. Limited supply is expected to naturally create demand. Examples include Bitcoin (BTC), Ripple (XRP), and Solana (SOL).

- Buy back and burn: Tokens are bought back from holders and burned. This permanently removes them from the supply. Binance Coin (BNB) burns 1% of its supply per quarter.

- Burn on transaction: The protocol’s contract specifies a tax on transactions that burns and/or distributes the tax among its holders. Safemoon (SAFEMOON) does both.

- Net deflationary model: The max supply is uncapped, but the burn rate from taxes or buy backs exceeds the rate of issuance. Curve (CRV) has become net deflationary at the time of writing.

Buy back and burn operations tend to be executed manually, which gives token issuers flexibility in the timing of buybacks and greater control over the market price. However, this often comes at the cost of decentralization. Protocols adopting this model may minimize centralization by involving a decentralized autonomous organization (DAO) in the decision-making process.

Burn on transaction models are most useful for controlling the inflation of uncapped tokens. Ethereum 2.0 recently added a deflationary mechanism with its London Hard Fork that involves burning its transaction fees. However, these models are entirely dependent on transaction volume. High fees may also encourage hoarding, which could lead to undesirable price swings and excessive speculation.

Tokens with a net deflationary model generally achieve equilibrium in their later stages since buy backs from early stage companies carry greater financial risk and transaction rates are not high enough to offset inflation. While this model encourages activity without hoarding, equilibrium is primarily driven by speculation and may be difficult to maintain throughout market cycles.

3. The Velocity Problem

The aforementioned tokenomics models are all susceptible to the “velocity problem”, which can be loosely defined as the tendency of users in a frictionless market to immediately exchange their tokens for goods and services. Velocity is expressed in the Equation of Exchange, which has been redefined below for cryptocurrencies and tokens:

MV = PQ

where

M = Market cap of the token

V = Frequency in which a token changes hands in a given time period (i.e. velocity)

P = Average price of goods and services purchased within this time period

Q = Number of goods and services purchased within this time period

The left and right sides of the equation can be interpreted as the total price of tokens spent and the total price of items bought, respectively, within a given time period. High velocity will cause an asset to be devalued, while low velocity will result in difficulty liquidating the asset. High velocity is often encountered by blockchain platforms with a “medium of exchange” token that is required to access a product or service. While the demand for this product or service may be extremely high, this does not necessarily translate to an increase in the value of the token. The solution is to create a token with more economic value to holders outside of its primary utility without incentivizing them to hoard it.

4. The Burn and Mint Equilibrium Model of Accumulate

After issuing its “activation block” of 150M ACME tokens and distributing an additional 50M ACME in a token swap for Factom’s FCT holders, 300M ACME tokens out of its 500M maximum supply will remain in the unissued pool. Every year, 16% of the tokens in the unissued pool will be minted to compensate stakers and validators. These tokens will be issued in intervals of approximately one month.

ACME tokens are burned to create Credits, and Credits are used to pay for services. When ACME tokens are burned, they return to the unissued pool to be minted in future blocks. As network usage grows, the burn rate of ACME will increase and fewer ACME tokens will remain in the circulating supply for that minting period. Since Accumulate uses a Proof of Stake (PoS) model to reward its stakers and validators, increased network use will incentivize the lockup of ACME tokens in staking pools and drive Accumulate towards a deflationary model.

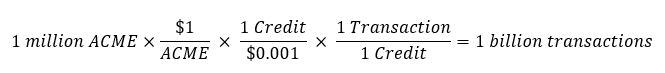

Equilibrium is achieved due to the inverse relationship between Credits and ACME tokens as illustrated in the following example. Assume a fixed cost of $0.001 per Credit per kilobyte of data and a minting rate of 1 million ACME tokens. A value of $1 per ACME token is supported with 1 billion transactions:

If network usage increases such that 1.5 million ACME tokens are burned each month, then the circulating supply will decrease and the value of ACME will increase. As the value of ACME increases, the number of Credits issued per ACME token will go up to support the increased demand on the network. Conversely, if network usage decreases, the circulating supply will increase and exert downwards price pressure. Thus, the price of ACME should scale linearly with network usage, which directly addresses the velocity problem.

5. A Transition from Speculation to Utility

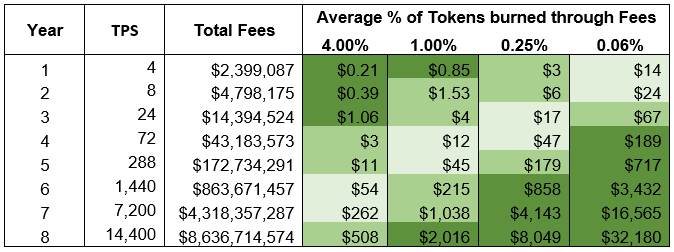

All utility tokens are initially driven by speculation. As network usage grows, speculation will decrease and the value of the token will be driven by utility. The following table models the transition from speculation to utility over time with different burn rates.

Each color represents the projected price of ACME as a function of burn rate and time, where the dark green band is least likely and the light green band is most likely based on estimated network use and speculation. The transition from speculation to utility is represented by the leftward movement of each shade over time, where utility is expected to dominate as the protocol matures. While not included in the table, a burn rate of 0% represents zero network use, while a burn rate of 100% represents the conversion of all circulating ACME tokens into Credits. The community would likely vote to increase the maximum supply in the latter scenario.

Utility is represented by the number of transactions per second (TPS), which is expected to increase with adoption of the protocol. Note that TPS is a function of protocol use, not protocol capacity. The current throughput of Accumulate is 70,000 TPS on the Testnet with a projected throughput of several million TPS over the next several years as more Block Validator Networks (BVNs) are added to scale the network.

6. The Value Proposition of Accumulate’s Two Token BME Model

The value proposition of Accumulate’s BME model is realized for enterprises who 1) want a predictable cost model 2) cannot legally hold cryptocurrency, and 3) need the flexibility to price their own services.

- Predictable costs: The price of Credits is tied to the USD and the number of Credits required to write data to the blockchain is fixed per kilobyte of network usage. This allows enterprise users to budget their data use long-term without worrying about market conditions.

- Legal compliance: Some users in both the public and private sectors cannot legally hold cryptocurrency. Since Credits are non-tradeable and non-transferrable, they are treated as a product rather than a security. Credits can be purchased from a third party.

- Flexible pricing: The Work Token Model pioneered by Augur is the only other deflationary model that addresses the velocity problem. However, it only works if service providers are offering a pure commodity. The BME model allows service provides to set their own prices and compete with other businesses on marketing, customer service, or other variables.

0 Comments